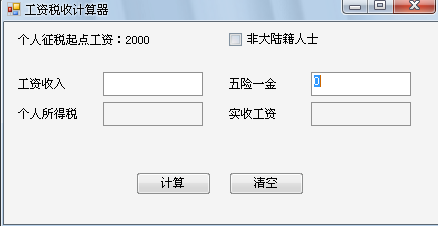

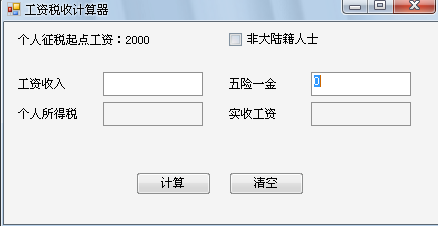

个人所得税计算器

计算器

2023-09-14 08:58:19 时间

今天心血来潮,编写了一个个人所得税计算器,呵呵,虽然功能不是很强,而且也是重复造轮子(网上也有许多的个人所得税计算器),不过“纸上得来总觉浅,绝知此事要躬行”,自己动动手绝对有好处的。

下面是个人所得税计算的类:

p /p pre code_snippet_id= 583882 snippet_file_name= blog_20150119_1_5116542 name= code "author-img" src="https://ucc.alicdn.com/avatar/img_4ef14db93886a6ec606ba64fc46212fe.jpg?x-oss-process=image/resize,h_150,m_lfit" />

潇湘隐者 网名潇湘隐者/潇湘剑客、英文名Kerry,兴趣广泛,广泛涉猎,个性随意,不善言辞。执意做一名会写代码的DBA,混迹于IT行业

下面是个人所得税计算的类:

1namespace SalaryComputer

public class PersonalIncomeTax

字段/属性#region 字段/属性

/**//// summary

/// 税率

/// /summary

private double[] taxRate = { 0, 0.05, 0.10, 0.15, 0.20, 0.25, 0.30, 0.35, 0.40, 0.45 };

11 /**//// summary

/// 税率(税率最好保存在数据库表里或xml文件,当国家出台新的个人所得税政策法规时,不需要修改代码部分)

/// /summary

public double[] TaxRate

get { return taxRate; }

set { taxRate = value; }

20 /**//// summary

/// 速算扣除数

/// /summary

private double[] subtractNumber = { 0, 0, 25, 125, 375, 1375, 3375, 6375, 10375, 15375 };

25 /**//// summary

/// 速算扣除数

/// /summary

public double[] SubtractNumber

get { return subtractNumber; }

set { subtractNumber = value; }

34 /**//// summary

/// 超过起征税的数额

/// /summary

private double[] surpassAmount = { 0, 500, 2000, 5000, 20000, 40000, 60000, 80000, 100000 };

39 /**//// summary

/// 超过起征税的数额

/// /summary

public double[] SurpassAmount

get { return surpassAmount; }

set { surpassAmount = value; }

48 /**//// summary

/// 征税起点工资

/// /summary

private double startTaxSalary;

53 /**//// summary

/// 征税起点工资

/// /summary

public double StartTaxSalary

get { return startTaxSalary; }

set { startTaxSalary = value; }

#endregion

63 构造函数#region 构造函数

/**//// summary

/// 无参构造函数

/// /summary

public PersonalIncomeTax()

StartTaxSalary = 2000;

72 /**//// summary

/// 征税基本工资有时会随国家政策,法律变更

/// /summary

/// param name="baseSalary" 征税基本工资 /param

public PersonalIncomeTax(double taxSalary)

StartTaxSalary = taxSalary;

#endregion

82 自定义方法#region 自定义方法

/**//// summary

/// 计算个人所得税,返回应缴税收,征税后所得薪水

/// /summary

/// param name="Salary" 薪水 /param

/// param name="Welfare" 五险一金数额 /param

/// param name="IsChinaNationality" 是否是中国国籍 /param

/// param name="taxedSalary" 税后所得实际工作 /param

/// returns 返回个人所得税 /returns

public double CalculatePersonTax(double Salary, double Welfare, bool IsChinaNationality, out double taxedSalary)

double RateSalary = 0;

95 RateSalary = Salary - StartTaxSalary - Welfare;

97 if (!IsChinaNationality)

RateSalary = RateSalary - 3000;

102 int rateIndex = 0;

104 if (RateSalary = 0)

for (int index = 0; index SurpassAmount.Length; index++)

if (RateSalary = SurpassAmount[index] RateSalary = SurpassAmount[index + 1])

rateIndex = index + 1;

break;

116 double rate = RateSalary * TaxRate[rateIndex] - SubtractNumber[rateIndex];

taxedSalary = Salary - Welfare - rate;

119 return rate;

122 #endregion

125

p /p pre code_snippet_id= 583882 snippet_file_name= blog_20150119_1_5116542 name= code "author-img" src="https://ucc.alicdn.com/avatar/img_4ef14db93886a6ec606ba64fc46212fe.jpg?x-oss-process=image/resize,h_150,m_lfit" />

潇湘隐者 网名潇湘隐者/潇湘剑客、英文名Kerry,兴趣广泛,广泛涉猎,个性随意,不善言辞。执意做一名会写代码的DBA,混迹于IT行业